Table of Content

Your length of service or service commitment, duty status and character of service determine your eligibility for specific home loan benefits. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. Eligible Native American Veterans can obtain a loan from VA to purchase, construct, or improve a home on federal Trust Land, or to reduce the interest rate on such a VA loan. Native American Direct Loans are only available if a memorandum of understanding exists between the tribal organization and VA.

For purchase home loans, payment in cash is required on all closing costs, including title search and recording fees, hazard insurance premiums and prepaid taxes. For refinancing loans, all such costs may be included in the loan, as long as the total loan does not exceed the reasonable value of the property. Interest rate reduction loans may include closing costs, including a maximum of two discount points. The amount VA will guarantee on a manufactured home loan is 40 percent of the loan amount or the Veteran’s available entitlement, up to a maximum amount of $20,000. These provisions apply only to a manufactured home that will not be placed on a permanent foundation.

VA Home Loans

The amount of the funding fee will vary based upon the type of loan, the nature of the borrower, the amount of a down payment, if any, and the term of the loan. The funding fee can also change based upon whether or not the borrowers have used a VA home loan in the past. Under the Home Loan Guaranty Program, VA does not make loans to Veterans and Servicemembers; VA guarantees loans made by private-sector lenders. The guaranty amount is what VA could pay a lender should the loan go to foreclosure.

A distinct advantage of using your VA loan is that you may not have to pay some of the additional fees normally paid at... Many borrowers get their COEs and scratch their heads because it says that their entitlement is only $36,000. An experienced VA loan officer can calculate your entitlement for loans above this amount. Most borrowers with full entitlement intact will have an additional $68,250 of VA backing available.

Chapter 6 Home Loan Guaranty

If approved, the purchaser will have to pay a funding fee that the lender sends to VA, and the Veteran will be released from liability to the federal government. VA home loan guaranties are issued to help eligible Servicemembers, Veterans, Reservists, National Guard members, and certain surviving spouses obtain homes, condominiums, and manufactured homes, and to refinance loans. For additional information or to obtain VA loan guaranty forms, visit /homeloans/.

The VA has established lending guidelines that make it easier for a veteran or active duty service member to buy and finance a home to live in. Buyers don’t have to come up with a down payment which keeps many buyers on the sidelines longer when trying to save up enough money for a down payment and closing costs. Not having to jump over that hurdle is a big plus for veterans. An eligible borrower can use a VA-guaranteed Interest Rate Reduction Refinancing Loan to refinance an existing VA loan to lower the interest rate and payment.

Oregon Vets Eligible For Home Loan Program

You must have served at least 181 days of continuous active duty and been discharged under other than dishonorable conditions. If you served less than 181 days, you may be eligible for a VA guaranteed home loan if discharged for a service connected disability. A funding fee must be paid to VA unless the veteran is exempt from such a fee because he or she receives VA disability compensation. Closing costs such as VA appraisal, credit report, loan processing fee, title search, title insurance, recording fees, transfer taxes, survey charges, or hazard insurance may not be included in the loan. For additional information or to obtain VA loan guaranty forms, visit/.

Instead, the VA guarantees a portion of these loans to help lenders offset the risk of loans. By doing so, it encourages lenders to make loans available to veterans on competitive terms. Also, regardless of how much the VA will guarantee, or how high the VA loan limit is in a particular county, a veteran will have to qualify for the loan based upon income, credit, and other requirements. VA loans made on or after March 1, 1988, are not assumable without the prior approval of VA or its authorized agent . To approve the assumption, the lender must ensure that the purchaser is a satisfactory credit risk and will assume all of the Veteran’s liabilities on the loan.

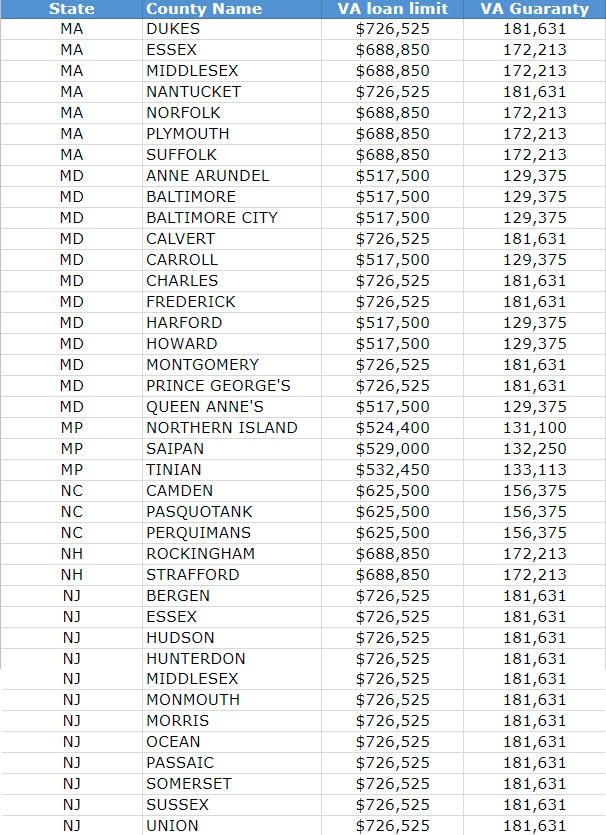

If the lender charges discount points on the loan, the veteran may negotiate with the seller as to who will pay points or if they will be split between buyer and seller. Points paid by the veteran may not be included in the loan . VA will guarantee 25 percent of the principal loan amount, up to the maximum guaranty. The maximum guaranty varies depending upon the location of the property.

You can purchase a condo instead of a house with a VA loan, learn more about loan qualifications and the benefits of buying a... To find out how much the guarantee will be on your VA loan, contact an approved lender.You can get free VA loan offers here. Proportionately speaking, loans under $144,000 can get a larger guarantee. As much as half of a VA loan under $45,000 can be guaranteed. The proportion of VA guarantee goes down as the amount of the loan goes up. When you obtain a Certificate of Eligibility for the first time, you may notice that your available entitlement is $36,000.

Loan limits were effectively raised from $144,000 to $417,000. These changes will allow more qualified Veterans to refinance through VA, allowing for savings on interest costs and avoiding foreclosure. All Veterans, except those who are specified by law as exempt, are charged a VA funding fee . Additionally, unmarried surviving spouses in receipt of Dependency and Indemnity Compensation may be exempt from the funding fee. For all types of loans, the loan amount may include this funding fee.

You might expect with a government-backed mortgage there will be some additional paperwork involved and the VA loan is no exception. You’ll have to obtain your Certificate of Eligibility for example from the VA. A loan officer with VA home loan experience knows to order that document directly from the VA instead of you having to mail, fax or otherwise make your request on your own. There is also what is known as “residual income” requirements for a VA home loan that other programs do not have.

However, certain high cost counties can have conforming limits higher than $417,000. This is to adjust for the higher cost of real estate in some areas. It’s rare, but some counties have VA loan limits that exceed $1 million, other counties have limits above $417,000 but less than $1 million.

If you’re experiencing financial hardship due to the COVID-19 emergency, you can request a temporary delay in mortgage payments. The Lender aid below outlines the required steps for lenders to gain access to the partner test environment. Assistance to Veterans with VA-Guaranteed Home Loans When a VA-guaranteed home loan becomes delinquent, VA may provide supplemental servicing assistance to help cure the default. The servicer has the primary responsibility of servicing the loan to resolve the default.

No comments:

Post a Comment